Buffered Index and Designed Income Offerings for March 2026

Minimum investment in the below offerings is $25,000

NOTE: Due to the volume of incoming investments, accounts must be processed and funded about 3 days prior to the Execution date of March 6, 2026.

The funding deadline date is set at March 3rd, 2026, the investable funds must be in place and available to invest by that time. If we miss the funding deadline, understand that rates are only guaranteed through the processing period, as the next month offering may be higher, or lower.

Offering #1: Designed Income March 6th, 2026

- Coupon Rate = 11.10% Annual Yield (coupon paid quarterly)

- Maturity: 36 months

-

Underwritten by Citigroup (CUSIP #17332UCC8)

-

Performance tracks lesser of Euro Stoxx 50, NASDAQ 100 and the S&P 500 indicies

-

-

Coupon Barrier 25.0% (call for info on this feature)

-

Income Example for a $100,000 Investment: Pays approximately $2,636 per quarter, ($10,545 annually) based on the parameters listed in the below PDF attachment Investment Addendum. Please call for info on this "Dividend-Type" income generating portfolio. The 11.10% quarterly coupon will be paid, even if the tracked indicies are down up to 25%.

- Principal Barrier 25.0% (tracked equity indexes, listed above, can literally be down up to 25% and your principal will be returned at the end of the 36 month maturity period. Call for full and complete info on this feature)

- Execution Date = March 6th, 2026

- Call Provisions: Issuer Callable after 1 year* and reviewed quarterly after 1 year (this is a protection feature for the issuer and client, call for more info on this feature)

- click PDF button below for full Designed Income presentation

- Also, See chart below for visual

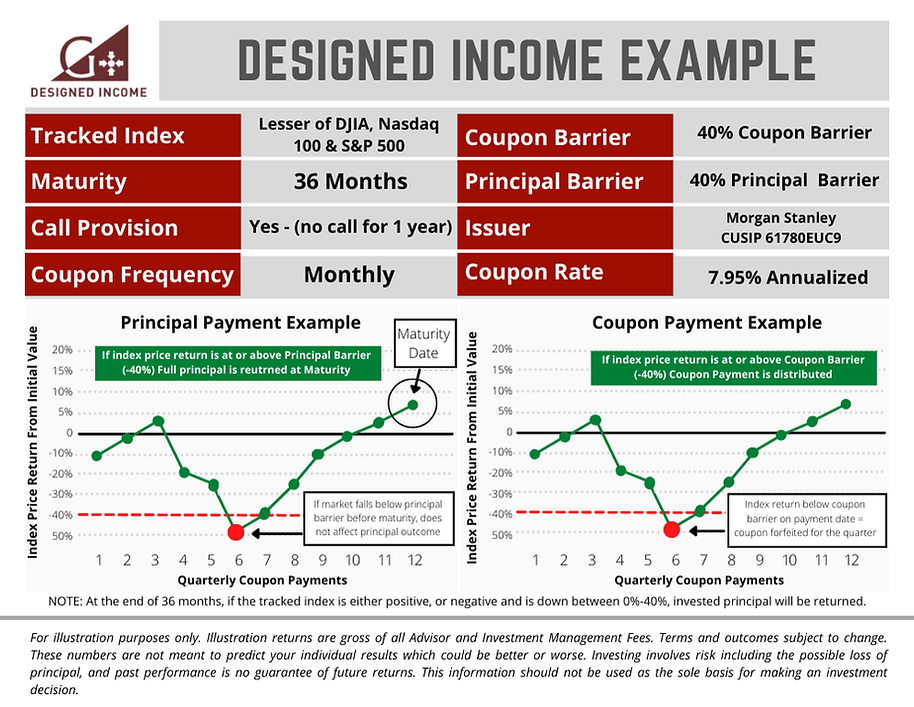

Offering #2: Designed Income March 6th, 2026

- Coupon Rate = 7.95% Annual Yield (coupon paid monthly)

- Maturity: 36 months

-

Underwritten by Morgan Stanley (CUSIP #61780EUC9)

-

Performance tracks lesser of DJIA, NASDAQ 100 and the S&P 500 indicies

-

-

Coupon Barrier 40.0% (call for info on this feature)

-

Income Example for a $100,000 Investment: Pays approximately $7,552.50 per year, paid monthly at the rate of $629.38, based on the parameters listed in the below PDF attachment Investment Addendum. Please call for info on this "Dividend-Type" income generating portfolio. The 7.95% monthly coupon will be paid, even if the tracked indicies are down up to 40%.

- Principal Barrier 40.0% (tracked equity indexes, listed above, can literally be down up to 40% and your principal will be returned at the end of the 36 month maturity period. Call for full and complete info on this feature)

- Execution Date = March 6th, 2026

- Call Provisions: Issuer Callable after 1 year* and reviewed quarterly after 1 year (this is a protection feature for the issuer and client, call for more info on this feature)

- click PDF button below for full Designed Income presentation

- Also, See chart below for visual

Offering #3: Dual-Directional Buffered Index March 6th, 2026

-

Term: 24 months

-

This portfolio does not participate in dividends

-

Underwritten by JP Morgan (CUSIP #46660JRF1)

-

Investment tracks lesser of the S&P 500 and DJIA Indices

-

-

Uncapped Growth Potential + 103% Par Rate - meaning you will capture growth of the tracked index returns at 103% of the gains. You will receive the full return of the index, even if it is 45.0%... In addition, it will enhance your gains by an additional 3.0%. Example: If the index returns 30% over the 24 months (for example) you would receive the 30.9% return, (remember, the percentage you can earn is uncapped, whatever the return is, you earn 100% of the gains, plus an additional 3.0%). If the portfolio earned 45.0%, you would be credited 46.35%, because your earning potential was uncapped, and enhanced by 3.0%. This portfolio also offers a certain level of protection of your assets, see below.

-

Offers a "Dual-Directional" buffer of 15.0%

-

What is a "Buffer"? A buffer offers a level of "market protection" to your assets. In this portfolio, it is "Dual-Directional". Example, if at the end of 24 months, the portfolio has dropped 17.0%, you would remove the buffer (market protection) of 15.0% and only be down 2.0%. However, this "Dual" feature also provides you with a return when the market loss is between 0% and (negative) -15.0%. Example: if the market was down 15.0% at the end of 24 months, you would actually receive the inverse of that loss, or a positive (+)15.0% return, which is a 30% swing! Or, if the market was down -10.0%, you would be up positive (+) 10.0% (a 20% swing). Any negative loss between 0% and 15% would offer you the opposite gain on the positive side, or what we call "dual-directional". Any market losses greater than 15%, you would then lessen your losses by 15%.

-

When markets are volatile, people are looking for ways to protect their assets, these buffers provide a nice buffer of market protection. These buffers can help for a portion of your funds, versus the protection of an annuity, and the long term contracts you commit to.

-

-

Execution Date = March 6th, 2026

-

This portfolio has no call provisions

-

Click the PDF button below for the full Dual-Directional presentation

%20UNCAPPED%20%2003-2026%20103%20Par.png)

Offering #4: Dual-Directional Buffered Index March 6th, 2026

-

Term: 24 months

-

This portfolio does not participate in dividends

-

Underwritten by Goldman Sachs (CUSIP #40058XEL4)

-

Investment tracks a single index, the S&P 500 index

-

-

CAPPED at 19.30%, meaning you will capture unlimited interest of the tracked index up to 19.30% over the 24 months. You will receive the full return of the index if it is 19.30% or less%... If the index returns 15.0% for example, you would earn the entire amount of 15.0%. If the index returns 22.0% (for example) you would receive a 19.30% return, as the percentage you can earn is capped at 19.30% because the offering company has been providing market protection to your investment on the downside of 20%.

-

Offers a "Dual-Directional" buffer of 20.0%

-

What is a "Buffer"? A buffer offers a level of "market protection" to your assets. In this portfolio, it is "Dual-Directional". Example, if at the end of 24 months, the portfolio has dropped 22.0%, you would add the buffer (market protection) of 20.0% and only be down 2.0%. However, this "Dual" feature still provides you with a return when the market loss is between 0% and negative -20.0%. Example: if the market was down 20.0% at the end of 24 months, you would actually receive the inverse of that loss, or a positive (+)20.0% return, which is a 40% swing! Or, if the market was down -10.0%, you would be up positive (+) 10.0% (a 20% swing). Any negative loss between 0% and 20% would offer you the opposite gain on the positive side, or what we call "dual-directional". Any market losses beyond 20%, you would then lessen your losses by 20%.

-

With a volatile market, people are looking for buffers, or some type of market protection. These are great options to get some level of protection on your investment, which can help for a portion of your funds.

-

-

Execution Date = March 6th, 2026

-

This portfolio has no call provisions, it will run 24 months.

-

Click the PDF button below for the full Dual-Directional presentation

%2019_30%20CAP%2003-2026%20100%20Par%20(1).png)

Offering #5: Buffered Offering March 6th, 2026

Term: 24 months

-

This portfolio does not participate in dividends

-

Underwritten by JP Morgan (CUSIP #46660JRG9)

-

Tracks the DJIA and the S&P 500 indices

-

-

This portfolio is intended to offer additional "buffers" (market protection) up to 30.00% of market losses at the end of the 24 month term. Example, if the tracked market indices are down 45% at the end of 24 months, you would only be down 15% due to market risk. If the tracked indices were down 30%, you would have no losses due to market risk. It provides a level of protection that a normal portfolio can't do. People ask, how can the offering investment company do this? You are essentially transferring the market risk to the offering company for 24 months, and their Investment Managers are investing the funds. Institutional firms don't just bet on the market going up, there are thousands of ways to make big gains in the market even when the market is flat, or negative.

-

Cap: 27.60% - this means that over the 24 months, you cannot earn interest above 27.6%. If the return at the end of 24 months is 27.6% or less, you would get the full return, if the index returned 31.0% for example, you would receive 27.6%. the offering investment company caps higher potential growth over 27.6% because in order to provide the client with 30.0% Market Loss Protection, this is necessary.

-

Execution Date =March 6th,2026

-

This portfolio has no call provisions, it will run 18 months.

-

Click the PDF button below for the full Buffered Index presentation

Offering #6: 100% Buffered Offering March 6th, 2026

-

Term: 18 months

-

This portfolio does not participate in dividends

-

Underwritten by Barclays (CUSIP #06749FML0)

-

Tracks the S&P 500 and the DJIA indices

-

-

This portfolio is intended to offer additional "buffers" (market protection) up to 100.00% of market losses at the end of the 18 month term. Example, your portfolio is down 30% at the end of 18 months, you would have no losses due to market risk and principal investment would be returned. If it was down 40%, you would also have no loss due to market risk. It provides a level of protection that a normal portfolio can't do. People ask, how can the offering investment company do this? You are essentially transferring the market risk to the offering investment company for 18 months, and their Investment Managers are investing the funds. Institutional firms don't just bet on the market going up, there are thousands of ways to make big gains in the market even when the market is flat, or negative.

-

Cap: 11.35% - this means that over the 18 months, you cannot earn interest above 11.35%. If the return at the end of 18 months is 11.35% or less, you would get the full return, if the index returned 15.50%, you would receive 11.35%. the offering investment company caps higher potential growth over 11.35% because in order to provide the client with 100% Market Loss Protection, this is necessary.

-

Execution Date = March 6th, 2026

-

This portfolio has no call provisions, it will run 18 months.

-

Click the PDF button below for the full Buffered Index presentation

If you have any interest in one of the above portfolios, please reach out to our office to set up a strategy meeting. This meeting is about an hour long and we take the time initially, to understand your needs and risk tolerance. (Please click here to our Risk Assessment webpage. The results will feed to us so we are prepared for our initial meeting).

As always, you can simply call our office phone number at: (480) 878-7444, or you can send us an email at: dan@risefg.com.

We look forward to meeting with you and having the opportunity to gain your business.

Sincerely,

Dan Anderson

Founder/Registered Investment Advisor

Rise Financial Group